Nevermind Newsweek’s decision to pander to big money interests and tabloid market dynamics, which they hope will sell lots of magazines… Niall Ferguson’s cover story is full of distortions and propaganda for a discredited political and economic philosophy. Almost immediately, the flagrantly dishonest article was thoroughly fact-checked and discredited, point by point, by other news outlets and scholarly institutions, while Newsweek admitted to not doing any fact-checking whatsoever. (More on this below.)

Niall Ferguson’s Newsweek cover story is a convenient political and economic fantasy, rooted in what must be a knowing misrepresentation of the economic truth of this moment in history. Newsweek’s editors should be embarrassed to have let a partisan diatribe like this through, much less to have the poor judgment to feature it as a cover story. In addition to his frequent misrepresentations of hard data, and factually unfounded smears of the president, Ferguson entirely ignores how grossly unhealthy our banking system really is, and why. (More on this below.)

How bad is the Newsweek screw-up?

Multiple fact-checks have shown that Ferguson:

- Switched years for key employment data, to blame Obama for what happened under Bush;

- Altered calculations of actual jobs records, to say Obama has killed jobs, when in fact he has created millions;

- Made up and/or inflated figures on household loss of real income;

- Tried to suggest that the entire Affordable Care Act would cost over $1.2 trillion, by not counting the parts of the law that pay for expanded insurance coverage provisions, and through which the law actually reduces deficits;

- Actually defended this last sleight of hand by openly describing what he did to make the numbers look bad for Obama, when in fact they favor him;

- Made a false projection of $222 trillion in future debt repayment shortfalls, without counting any of the actions being taken to ensure that such figures will never become real;

- Ignored and/or lied about the biggest drivers of that projected shortfall being healthcare market pricing, Defense spending and the Bush tax cuts;

- Omitted and/or lied about the fact that Pres. Obama has taken action to deal with all three;

- Falsely alleged that Obama fully ignored the Simpson-Bowles deficit commission recommendations (he used them as part of the framework for budget and debt-ceiling negotiations);

- Praised Paul Ryan for fiscal “courage”, though Ryan voted against the Simpson-Bowles commissions recommendations;

- Misrepresented in almost every detail Pres. Obama’s record on foreign policy and national and international peace and security;

- Misrepresented Pres. Obama’s interest in, understanding of, and actions regarding the democratic awakening of populations living under authoritarian governments across the Arabic-speaking world…

The most comprehensive and widely circulated fact-check of the article, by Matthew O’Brien at The Atlantic, calls Ferguson’s article “a counter-factual history of the last four years”. O’Brien observes that, far from providing a researched and factually-based argument for his views, “Ferguson delves into a fantasy world of incorrect and tendentious facts. He simply gets things wrong, again and again and again.”

As the Atlantic fact-check notes, Ferguson attempts to saddle Obama with millions of job losses and Social Security Disability recipient increases that actually happened while Bush was still president or before the Recovery Act became law. The tax policy of George W. Bush, who gave more free cash to corporate interests and to the richest Americans than any other president in history, drained the consumer market economy of resources, a trend which caught up with him in 2008, when the US stock-trading, credit, jobs and housing markets, all experienced record collapse, almost simultaneously.

It turns out, when the truth is taken into account, that Pres. Obama’s policies have created 3.1 million new jobs since 2009—four times what Bush was able to create in the seven years prior to the 2008 crash. What hobbled economic growth and saw two recessions during Bush’s term, the second being the worst economic decline since the Great Depression, rife with millions of foreclosures and potentially hundreds of bank failures, was bank bloat—a condition of financial malady based on deliberately flawed accounting. (More on this below.)

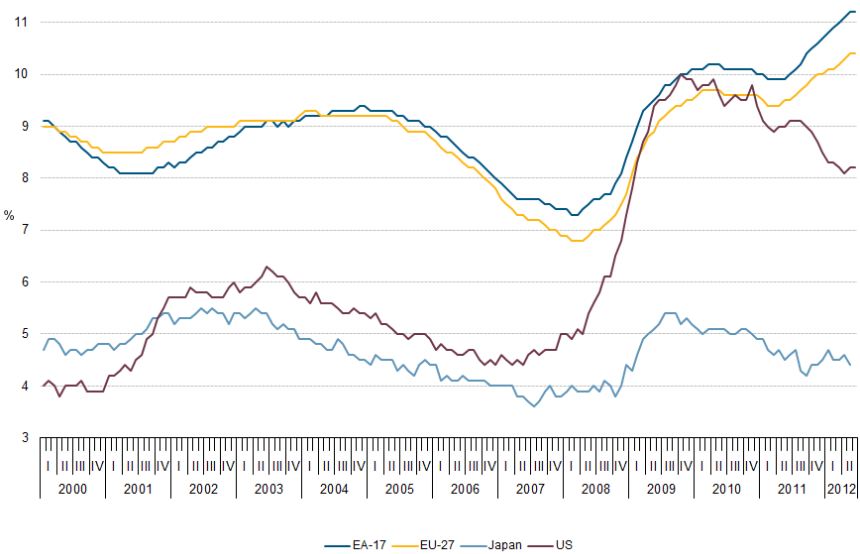

In fact, Ferguson seems to conveniently ignore data that show the beneficial effect Pres. Obama’s economic policies have had, in reducing the catastrophic fallout from the worst financial crisis in eight decades. This analysis clearly shows that since the American Recovery and Reinvestment Act began to take effect, in the late 2nd quarter of 2009, job losses in the United States have been steadily declining, with employment opportunity spreading, however gradually—whereas both the Euro currency area (EA-17) and the European Union more broadly (EU-27) have seen the crisis worsen.

How and why our banking system is ailing (1999-2012):

When then outgoing Pres. George W. Bush and his administration engineered the largest direct redistribution of wealth in world history, from ordinary Americans to the 10 biggest banking conglomerates in the United States, they did so telling Congress that the crisis was incomprehensibly, inexplicably widespread, and urgent, and they were right, in at least one genuinely alarming way, which can be broken down as follows:

The banking system had become dependent on systemic and escalating overvaluations of lending accounts, so that:

- There was no longer anything close to the amount of real money in circulation to account for the unprecedented claims of private wealth holdings, on which the banks were basing their operations, and…

- Without an immediate infusion of record sums of money, major banks would start to unravel…

The problem Pres. Barack Obama would face, immediately upon taking office, on January 20, 2009, was not a “slumping consumer economy” or “a bad job market”; it was not “flagging consumer confidence” or “a decline in purchases of durable goods”. All of those things were happening, but they were merely symptoms of a larger, more widespread “perfect storm” of economic frailty, and that perfect storm was driven by one dominant trend: the banks were not honest about what their operations were worth, or why.

The truth is that the banking system was grossly overvalued in 2008, in ways that tied into the finances of every household, business and municipality, even state pension plans and payrolls, across the United States. The impulse to overvaluation became so rampant that significant problems inherent in one after another banking project or line item were overlooked, sometimes explicitly dismissed, as being little more than untoward appearances rooted in an old-fashioned way of thinking.

There have been as many attacks on Obama for not doing more to donate taxpayer money to the propping up of the banking system as there are attacks on him for not withholding all taxpayer funds from the banks and other economically hobbled corporate interests. That is largely because not everything is known about the real condition of the banks, at the time of the taxpayer-funded bailouts. The one thing the Treasury Department has made clear about the banks’ health, both under Bush and Obama, is that there is too much wrong to make all of it public; there is a real economic and security interest for the United States, for its citizens and for its trading partners, in making sure the banking industry looks solvent.

Ferguson mentions none of these facts, except for the nation’s biggest banks being “at least $50 billion short of meeting new capital requirements”, under the Basel III accords. He first disregards the nation’s not having fully adopted these international rules, then—either from ignorance or from lack of interest—fails to mention the problem of so much of the asset claims of major banks being, in themselves, fictional.

How we got into this mess (1969-2008):

During the three decade run-up (1969-1999) to the boom in undisciplined conglomerate banking (1999-2008), banks were given little nudges in the direction of wealth-only banking. The reason? It is easier to make money from money, so in dealing only with high-end accounts, banking institutions could more reliably do what they want to do: lend, retrieve the wealth desired, lend again for higher amounts, and count the increases as profits earned.

If you know the people whose money you manage are financially secure, and will have more money in the future, it is easier to make your projected earnings grow, and to back up those claims of future profits. It is easier for the banker, in other words, to talk up future earnings and to celebrate himself for earning them, if everybody is already wealthy, and there are policies in place to direct funds from less affluent outsiders into the pool of wealth available to one’s clients.

The question is whether taking shortcuts allows for proper application of a word like earnings.

During the Internet boom-time of the 1990s, money was pouring in from across the world, as digital valuations of investment capital kept increasing in unprecedented and hard-to-predict ways. Some astute observers warned of a bubble and a coming crash. Others ignored the warning.

Alan Greenspan famously worried about the “irrational exuberance” of dot-com investors. (Greenspan, of course, would then become the most powerful irrationally exuberant backer of banking deregulation that led directly to the undisciplined conglomerate banking boom and its long-term assault on the Americacn middle class economy.)

When key regulations from the Glass-Steagall Act were repealed, in the Gramm-Leach-Bliley Financial Modernization Act of 1999, large banks were pushed into an eat-or-be-eaten free-for-all, in which gobbling up competitors became necessary to maintaining the radical increases in bank holdings and future earnings projections, to which major financial institutions had become accustomed. But takeovers and mergers are sometimes little more than a way of borrowing against the future:

For instance, Bank A holds 8% of the national market; Bank B holds 4%. After the takeover of Bank B by Bank A, the new Bank AB now controls 12% of the national market. This makes Bank AB worth more than the combined total of the two institutions that formed it. At least, this is how Bank AB will report its assets under management, its growth potential, the value of its market position, its attractiveness as an investment, or business partner, and its consequent borrowing and lending power.

This last is extremely important, because it allows an institution that is actually struggling to maintain its own profit projections to claim a significant, though phantom, increase in market value. The repeal of Glass-Steagall allowed for and invited rampant distortions in the real market value of financial assets: a single institution could now borrow money from one of its own subdivisions, “repaying” it immediately after borrowing a larger sum from the Federal Reserve or from another bank, using that borrowed money as collateral (and, effectively, counting it twice on the overall institution’s balance sheet, at least for a few days.

These sorts of games became commonplace, and accounting methods were “modernized” to cope with the new way of counting money… to compete with other institutions that would use numbers to make numbers grow, even before lending, borrowing or earning a penny. Appearances could stand in for reality; projections could manifest as profits, whether there was actual real-world activity to support every dollar and every cent.

It is not known exactly how much of the growth in bank-held assets, between 1998 and 2008 was the result of this kind of asset inflation, but the growth in total US financial wealth was near $50 trillion, while the all-time record bailouts totaled less than $3 trillion.

When the Obama administration subjected the nation’s biggest banking conglomerates to the uncomfortably invasive financial accounting “stress tests”—as a condition of deploying the second half of the TARP funds (Troubled Asset Relief Program) and the expansion of FDIC insurance on personal accounts from $100,000 to $250,000 per account—, the financial sector was thrown into an uproar, primarily because it became evident that most, perhaps all, of the major banks could not survive a deeper crisis without government assistance.

The ration of real assets to claimed wealth holdings was so low that it was not evident any o the biggest banking conglomerates could actually follow through on its promises to depositors and investors. Every time any bank built a loan, a lending program, or a new division, around these kind of inflated wealth claims, it borrowed against the future; now, the banks are caught in a mathematical trap: they need to grow—or appear to grow—to show health, but their ill health stems from their doing too much of that, and this behavior needs correcting.

Many of the world’s leading economic analysts and observers have suggested there is no better solution than to continue gradually doing what is possible to shore up the dysfunctional banking sector, steering more investment capital—through both tax policy and more direct assistance—to the kind of projects that build value at the human scale. And, the solution is, and must be, gradual, because the stark choice we really do face is:

- either: gradual but steady improvements throughout the system or the sudden…

- or: the sudden shock of a widespread banking collapse and its painful but maybe curative aftermath…

Mitt Romney famously said Detroit should be allowed to fail—Detroit being the auto industry, one of the most significant drivers of American economic health and expansion. Many have asked if he would do the same to the financial sector; so far, Romney—a leading beneficiary of the Bush-era boom in undisciplined conglomerate banking, offshoring of wealth and asset inflation—has not spoken up for letting the banking system collapse.

Ferguson ignores this underlying framework for the present global crisis in banking, as relating to the human-scale economy, because he does not have a solution, does not harbor affection for anyone in politics who does have a worthwhile solution to what is not working at the human scale, and is more focused on writing a bitter partisan diatribe than on reporting the truth of the matter.

Key distortions in Ferguson’s budget rhetoric:

Ferguson’s article distorts a lot of details of the agonizingly flawed process of federal budgeting. In 2001, when George W. Bush took office, the process of calculating the federal budget over the coming decade was shifted, from an arithmetically founded budget rooted in real commerce, real wealth and the strength of a growing middle class, to an arithmetically unfounded “supply side” philosophy, rooted in the assumption that increased wealth for the wealth generates future wealth for everyone.

In 2009, when Barack Obama took office, Sen. Mitch McConnell, leader of the Republican Senate conference, pledged to use budget and economic policies to “destroy” the Obama presidency. This empowered the Republican House, sworn in under Speaker John Boehner, in 2011, to oppose two major budget-fixing projects, which would do nothing to undermine the programs in question, but would save taxpayers upwards of $1 trillion over ten years.

Republicans in the House and Senate refused to support cuts to federal spending that would target ONLY “fraud, waste and abuse” in Medicare, Defense and Homeland Security. Those ant-fraud projects would save more than $1 trillion over ten years, without reducing services or affecting military readiness, salary or supply. Even where such provisions have made it into law, as part of the Affordable Care Act, Defense Reauthorization or Budget Sequestration deal, Boehner and McConnell have sought to obstruct such efforts.

Ferguson ignores the impact of that political maneuvering, which was the intended impact: to make it appear as if Barack Obama got the numbers wrong on deficit reduction, on economic stimulus, and is not an adequate or honest steward of the federal budget. Nevertheless, Ryan’s unwillingness to correct the bad fiscal math inherent in the Bush tax cuts for millionaires and billionaires—coupled with his determination to vastly expand tax breaks for corporations and the already wealthy—means his plan has no honest hope of balancing the federal budget.

Yet Ferguson defends that plan as viable, courageous and our “only hope”.

All of that is just about the framing of Ferguson’s argument. Here is perhaps the most craven misrepresentation of the entire article: Ferguson falsely alleges that the Patient Protection and Affordable Care Act—which he refers to erroneously as “Obamacare” and “Pelosicare”—will add $1.2 trillion to the federal budget deficit over ten years, and he claims to get this information from the Congressional Budget Office.

The Atlantic’s fact-check suggests:

Maybe Ferguson doesn’t understand the meaning of the word “deficit”? The only other explanation is that he is deliberately misleading his readers. The CBO is quite clear about Obamacare’s budgetary implications. It reduces the deficit. Here’s what the CBO said exactly:

“[T]he effects of the two laws on direct spending and revenues related to health care will reduce federal deficits by $210 billion over the 2012-2021 period.”

In other words, the law is more than paid for. As Paul Krugman pointed out, it does spend $1.042 trillion covering people, but it pays for this coverage by finding savings in Medicare and levying a surtax on investment income for high-earners. That Ferguson looked up the CBO’s estimate of the bill’s cost and didn’t notice that those costs are paid for is peculiar indeed. Even more peculiar is that he is apparently doubling down on this falsehood. And yes, it is a very deliberate falsehood.

Joe Weisenthal is scathing in his critique, going after Ferguson’s persistence in distorting evidence, even in his rebuttal to those who point out that he has distorted evidence:

On Twitter @nycsouthpaw catches another glaring case of Niall Ferguson abusing the CBO’s words.

In Ferguson’s new post he quotes the CBO as saying:

If you are wondering how on earth the CBO was able to conclude that the net effect of the ACA as a whole was to reduce the projected 10-year deficit, the answer has to do with a rather heroic assumption about the way the ACA may reduce the cost of Medicare. Here’s the CBO again:

“CBO’s cost estimate for the legislation noted that it will put into effect a number of policies that might be difficult to sustain over a long period of time. The combination of those policies, prior law regarding payment rates for physicians’ services in Medicare, and other information has led CBO to project that the growth rate of Medicare spending (per beneficiary, adjusted for overall inflation) will drop from about 4 percent per year, which it has averaged for the past two decades, to about 2 percent per year on average for the next two decades. It is unclear whether such a reduction can be achieved …”

Indeed, it is, which is why I wrote what I wrote.

Ferguson italicized the last line about it being unclear if such reductions can be achieved, as if this line undermines the whole thing.

But Ferguson is truncating the CBO’s quote.

Here’s the full quote from the same report:

In fact, CBO’s cost estimate for the legislation noted that it will put into effect a num- ber of policies that might be difficult to sustain over a long period of time. The com- bination of those policies, prior law regarding payment rates for physicians’ services in Medicare, and other information has led CBO to project that the growth rate of Medicare spending (per beneficiary, adjusted for overall inflation) will drop from about 4 percent per year, which it has averaged for the past two decades, to about 2 percent per year on average for the next two decades. It is unclear whether such a reduction can be achieved through greater efficiencies in the delivery of health care or will instead reduce access to care or the quality of care (relative to the situation under prior law). Also, the legislation includes a provision that makes it likely that exchange subsidies will grow at a slower rate after 2018, so the shares of income that enrollees have to pay will increase more rapidly at that point, and the shares of the premiums that the subsidies cover will decline.9 Such possibilities could lead to pressure on law- makers to adjust those policies.

So the CBO is not saying that the deficit reductions are unclear. What’s unclear is how they will be achieved.

Distortions of this kind permeate the entire fabric of Ferguson’s article, and they are there for a reason. He needs to alter the data emerging from the actual economic landscape of this moment in history, because he wants to tell a story about the “radical” (Ferguson’s own word) and mathematically infeasible policy proposals being pushed by Pres. Obama’s opponents.

This allows Ferguson to elevate the radical and mathematically challenged budget philosophy of Romney’s VP choice, Rep. Paul Ryan (R-WI). While credible economic observers note the factual inviability of Ryan’s budget proposals, not to mention their antiseptic vagueness and severely detrimental impact on real people, Ferguson says it is America’s “only hope”.

Where rhetoric trumps the truth:

In his critique of the Ferguson’s Newsweek hijacking, James Fallows takes issue with the following claim:

In Tokyo in November 2009, the president gave his boilerplate hug-a-foreigner speech… Yet by fall 2011, this approach had been jettisoned in favor of a ‘pivot’ back to the Pacific, including risible deployments of troops to Australia and Singapore. From the vantage point of Beijing, neither approach had credibility.

Fallows observes that:

The “from the vantage point of Beijing” assertion is based on no adduced evidence, and based on my experience and interviews there is more or less the opposite of the truth. Again, note that a Harvard professor of history uses the phrase “boilerplate hug-a-foreigner speech.”

Even the headings and graphs in the article are inflammatory and misleading. At the bottom of page 22 of this edition of Newsweek, in the center column, Ferguson adds a graph intended to show what he calls Obama’s “EPIC BUDGET FAIL”. This is a Harvard professor, purporting to be an historian with knowledge of economic and political facts, trendlines and consequences, yet who distorts the information in the graph in question, using the half-asleep slang of college kids on a reality TV game show. It is shameless hyperbole, unsupported even by the graph for which it serves as a caption.

The graph in question shows the budget deficit projections that emerged from the flawed data published by the Bush administration, and which was the only government data the Obama administration could work with when it took over. The data were flawed in part, because there was a habit of reporting real data in phases, under the Bush administration, correcting significant mistakes months or even years later. They were also flawed, because the scope of the Wall Street / credit / housing crisis was far more widespread and entrenched than anyone knew in early 2009.

That the actual deficits are higher than the projections emerging from that flawed data is knowable only because the Obama administration has improved significantly on the reporting of government spending and consumer market data. One of those improvements was the decision to include all of the costs for the wars in Iraq and Afghanistan—also far more costly than had previously been reported—in the federal budget projections. Nevertheless, the graph still shows the Obama administration getting deficits under control and steadily reducing them.

Ferguson repeatedly uses a simple rhetorical tactic to mislead his readers—and apparently his editors at Newsweek: he switches out evidence from the real world for absolute statements that carry so much emotional content, he could only undermine them by adding detail. He falsely asserts that Obama “did nothing to address the core defects of the [healthcare] system”, which he outlines as:

- “the long-run explosion of Medicare costs as the baby boomers retire”;

- “the ‘fee for service’ model that drives health-care inflation”;

- “the link from employment to insurance that explains why so many Americans lack coverage”;

- and, of course, his Republican friends’ favorite scapegoat: the right of the American people to access the courts…

Item 4 is a non-starter, because the Constitution explicitly forbids the Congress from making any law that would abridge the right of the people to seek redress for grievances. An existing right to sue cannot be curtailed. Still, the Affordable Care Act does help to create new channels of mediation that should reduce the temptation to use the courts as the only means of seeking redress.

Items 1, 2 and 3, are all the result of the private-sector for-profit marketplace for healthcare service delivery and compensation. The solution Ferguson seems to be hinting has not been tried is the single payer system that his preferred candidates have vowed to oppose in every way possible. It does not seem, from his rhetoric, that Ferguson would embrace a single-payer system, but he will use the flaws of the private health insurance markets to attack Barack Obama, because that is his only real interest in writing this article.

The Affordable Care Act actually does specifically address each of items 1, 2 and 3, so again, for Ferguson, the temptations of inflammatory rhetoric trump the value of presenting his readers with the facts in evidence.

On page 24, Ferguson makes the astounding claim that:

Far from developing a coherent strategy, he believed—perhaps encouraged by the premature award of the Nobel Peace Prize—that all he needed to do was to make touch-feely speeches around the world explaining to foreigners that he was not George W. Bush.

This is an absurd lie. What about achieving the historic START II treaty for nuclear disarmament with the Russian Federation? What about killing Bin Laden? What about drone strikes in Yemen, Somalia, Pakistan? What about military action against piracy? Special forces in Uganda? Successfully working with China to reprimand North Korea (a first)? What about tough sanctions against Iran? Stuxnet? What about extricating the United States from Iraq, as promised?

The truth is: the extreme falsehood of Ferguson’s claims about Obama’s military decision-making is one of the strongest cases for the moral and intellectual bankruptcy of his writing in this Newsweek cover story.

Longing for the ‘imperial presidency’?

Just above the graph on page 23, Ferguson includes this strange sentence: “After the imperial presidency of the Bush era, there was something more like parliamentary government in the first two years of Obama’s administration.” What Ferguson is referring to is representative democracy, in which a parliamentary process (the US Congress debating and enacting legislation, so that law—and not tyrants—may rule) is carried out by individuals elected by the citizenry to steer national policy in a more just and humane direction.

Is Ferguson opposed to democracy? Does he long for a more authoritarian way of enacting economic policy? A planned economy? He praises China for its GDP growth and suggests that the Obama administration is getting it wrong for not being more like China, which as a state-run nationalist-capitalist economy in which only the Communist party is allowed to rule, and ordinary people have no vote whatsoever.

In one of Business Insider’s intense critiques of the article, Ferguson is accused of longing for the bad old days of hard-line British imperialism:

The most important insight we can have into this man Ferguson is that he wants the United States citizenry to be more militant, to have a zeal for imperialism, or so goes a review of Colossus:The Price of America’s Empire. Instead of just enjoying the comforts of family and the fruits of American prosperity, Niall would want us to be like his old British empire, with an appetite for world domination.

What is going on at Newsweek?

First of all, Newsweek has explicitly, embarrassingly and unfortunately, been forced to admit that it does no fact-checking at all. It has no fact-checkers on staff. The article was not fact-checked. That explains a lot. But it does not explain how not one editor, editorial staffer, intern, nor anyone involved in layout and design, noticed the vitriolic confabulations posing as facts, the distorted data not lining up with what informed observers already know, or the campaign-ad demeanor of the piece, sounding like it had been paid for by the Romney/Ryan campaign.

The Columbia Journalism Review is unforgiving in its critique:

It’s been a long time since I’ve seen a cover story so comprehensively demolished as Newsweek‘s disingenuous anti-Obama piece by Harvard’s Niall Ferguson, who puts together a greatest-hits compilation of the right’s economic smears of the past three-plus years.

Behind what is misrepresented as a link to Paul Krugman’s rebuttal and Niall Ferguson’s response, Newsweek presents only Ferguson’s bombastic and dishonest “response”, leading with the following artfully rendered subheader: “The liberal New York Times blogger objected to ‘multiple errors and misrepresentations’ in this week’s Newsweek cover story on Obama’s record in office. Author Niall Ferguson rebuts the charges.”

Paul Krugman does write a blog for the New York Times, called “Conscience of a Liberal”, but unlike Ferguson, Paul Krugman is not writing as an ideologically narrow-minded “blogger”: he is a Nobel Prize-winning economist, and his position at the Times is not “blogger” but columnist. His economic research and work product are not “liberal” but factual; it is Ferguson who makes his living endorsing, distorting and puffing up a discredited ideological perversion of economic reality.

Newsweek should know better than to try so unashamedly to flip that coin.

As of this writing, Newsweek itself has been silent on the unethical mess of confabulation posing as its cover story, issuing only this statement: “Niall Ferguson has responded to Paul Krugman’s critique. Newsweek continues to monitor the debate.”

There is no regard in this reply—or in the dismissive admission that Newsweek, “like other news organizations”, does not fact check—for the truth. The article is considered—precisely as Ferguson would have it—to be one version of reality, requiring no connection to facts in evidence or anyone else’s lived reality. That posture simply cannot be the whole of Newsweek’s view of whether the truth matters in journalism.

In case they need encouragement to take responsibility and issue the appropriate retraction and corrections, here are some more fact-based critiques:

- The Atlantic - A Full Fact-check of Niall Ferguson’s Very Bad Argument Against Obama

- The Atlantic - As a Harvard Alum, I Apologize

- The Atlantic - Paul Krugman Shows Newsweek How to Fact-check

- Paul Krugman - Unethical Commentary, Newsweek Edition

- New York Magazine - Niall Ferguson Smacked Down over Another Questionable Newsweek Cover

- Columbia Journalism Review - Newsweek’s Niall Ferguson Debacle

- Politico - Newsweek Silent on Niall Ferguson Errors

- Salon - Niall Ferguson trolls everyone at Newsweek

- Slate - Niall Ferguson’s Absurd Critique of the Obama Administration in One Chart

- Business Insider - Niall Ferguson Publishes Embarrassing Defense of Newsweek Article

- Business Insider - Niall Ferguson Proves the UK Bankers Want to Take Control of an Imperialist US

- MSNBC PowerWall - Newsweek’s Anti-Obama Cover Story: Has the Magazine Lost all Credibility?

- MediaMatters - Newsweek, Niall Ferguson and the Conservative Echo Chamber

- Brad DeLong - More Lies from Niall Ferguson…

- Foreign Policy - The Laziest Paragraph I will Read Today (warning against shoddy work by NF, from 2011)

Ultimately, we must ask: why is Newsweek—which has consistently explained what is wrong with the “trickle-down” theory of economic growth Ferguson backs, and for which Mitt Romney and Paul Ryan are perhaps the most aggressive and fundamentalist proponents in presidential campaign politics to date—framing the 2012 election according to an unfounded economic hypothesis which over the last 40 years has diverted more wealth from ordinary Americans to the ultra-wealthy, and which led to the 2008 collapse?

We cannot speculate here as to the exact psychology of the publishers, or the discussions going on behind closed doors, because we are not privy to that information. But we can say, without any uncertainty, that Newsweek has, at least for this edition, handed its journalist brand to the most dangerous distortions of economic and political reality currently in the wind. This is a stain on its journalistic record from which it will be very hard to recover any time soon.

New York magazine’s response puts it like this:

Suffice it to say, as the pile-on continues, the online traffic for the article is probably insane, but in no way worth it. Is this just what’s become of the Tina Brown method? Since she took over as editor of the struggling newsweekly that combined with her Daily Beast, the magazine has faced repeated criticism for what certain corners of the Internet refer to as trolling. From Michelle Bachmann’s gaze to Zombie Princess Di, Gay Obama, and Wimpy Mitt Romney, Newsweek covers have grabbed attention (which does not necessarily translate to sales).

But the Brown brand of getting people chattering with eye-popping covers and counterintuitive takes isn’t the same as willingly distorting the truth. As Krugman writes, “We’re not talking about ideology or even economic analysis here — just a plain misrepresentation of the facts, with an august publication letting itself be used to misinform readers.” With the future of the print product already in doubt, cheap clicks at the expense of credibility just aren’t going to cut it.

Not to discount entirely the value of rhetorical flourish: By the end of Niall Ferguson’s article, a fair minded and at least moderately informed reader might have a strong feeling that the bold-faced NW marking the end of the story stands for “not worthy”.